are political contributions tax deductible in virginia

Except that for 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction. 1 Best answer.

Are Political Contributions Tax Deductible H R Block

For 2021 this amount is up to 600 per tax return for those filing married filing jointly and 300 for other filing statuses.

. Here are the main reasons why. For taxable years beginning on and after january 1 2000 but before january 1 2017 any individual shall be entitled to a credit against the tax levied pursuant to 581-320 of an amount equal to 50 percent of the amount contributed by the taxpayer to a candidate as defined in 242-101 in one or more primary special or general elections. The other two would beBUT if you transferred your 2016 tax file into your 2017 file those donation check-offs usually auto-transfer into the 2017 tax return too as charities.

Political contributions are not deductible on your federal tax return. Political Campaigns Are Not Registered Charities. Typically youll list any charitable donation deductions on Form 1040 Schedule A.

Are political contributions tax deductible in virginia Saturday May 7 2022 Box 545 Edinburg VA 22824. Political parties are not. Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either.

How Stock Option Taxes Work. Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

31 of the taxable year you may deduct the entire amount contributed during the taxable year. 14 2022 Published 1009 am. Google Overtakes Goldman Sachs In Us Political Donations Financial Times.

June 1 2019 412 AM. Political contributions arent tax deductible. Looking for Tax Breaks.

According to the IRS. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. Are voluntary contributions from my Virginia return tax deductible.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. Virginia 529 Virginia529 is a 529 college savings plan that offers flexible affordable tax-advantaged savings for qualified higher education expenses through its four programs.

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. Home Mortgage Interest Deduction. You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and candidates.

Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. Virginia is one of a handful of states with few restrictions on campaign donations. The same goes for campaign contributions.

In a nutshell the quick answer to the question Are political contributions deductible is no. If you contributed more than 4000 per account during the taxable year you may carry forward any undeducted amounts until the contribution has been fully deducted. Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS.

The answer is no political contributions are not tax deductible. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

Any contributions will be deemed to be for taxable year 2019. Not All Political Contributions Are Tax-Deductible By Robin Hill-Gray. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Individuals can donate up to 2900 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee. According to the IRS. However if you are age 70 or older on or before Dec.

Virginia is one of a handful of states with few restrictions on campaign donations. The IRS guidelines also go beyond just direct political contributions. Given that political donations arent tax deductible its important to familiarize yourself with IRS rules regarding the deductibility of charitable contributions.

You can only claim deductions for contributions made to qualifying organizations. Political contributions deductible status is a myth.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

States With Tax Credits For Political Campaign Contributions Money

Atu Cope Amalgamated Transit Union

Florida S Investor Owned Utilities Spent Heavily On Republican Interest Groups In 2020 Elections Energy And Policy Institute

Are Political Contributions Tax Deductible H R Block

How Much Should You Donate To Charity District Capital

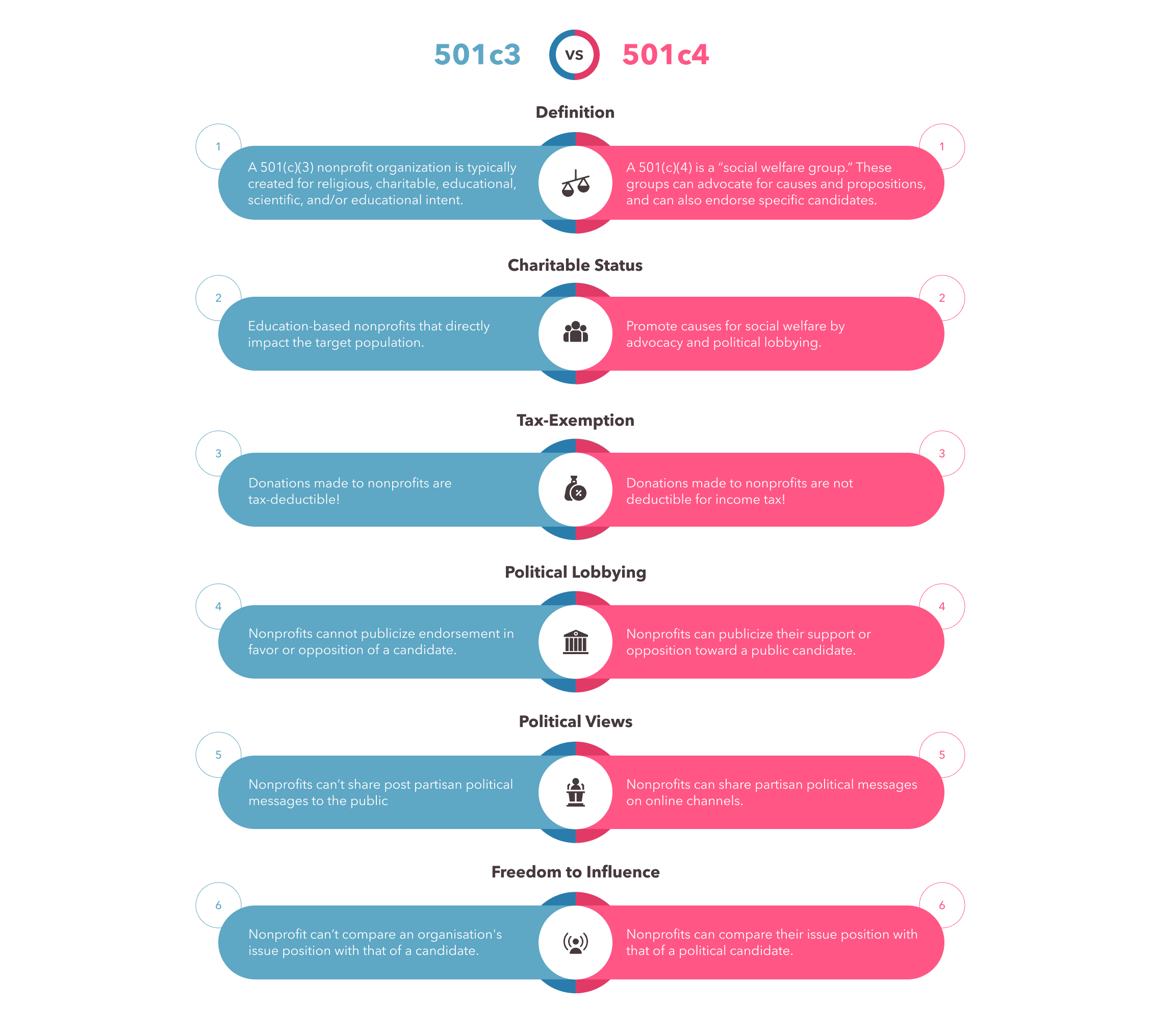

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

The 4 Tax Strategies For High Income Earners You Should Bookmark

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Examples Of Itemized Deductions

Charitable Deductions On Your Tax Return Cash And Gifts

Free Political Campaign Donation Receipt Word Pdf Eforms

Political Contributions Political Donations Solutions Paypal

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)